- City States: the real engines of growth

- Five Ways to Invest with the Nerd Nation

This article is the fifth in a series about investing in technology – arguing that the key to finding great opportunities and negotiating the next few years of wild industrial weather is to focus on technologies that produce actionable data, and in particular, those companies that are terraforming the planet for digital life.

In the decade that followed the collapse of the USSR, a great exodus of scientific talent took place as nearly a million Russian jews emigrated to Israel.

More than half of the immigrants came with advanced degrees in engineering and science, and free of political restraint, they were eager to put their particular expertise — telecommunications, military hardware — to immediate use.

Israel boomed.

And today Tel Aviv is buzzing with high-tech startups in cybersecurity, batteries, agro-technology, water filtration and advanced vision systems.

It is a great example of what urbanist Saskia Sassen calls a “niche global city”. Tel Aviv has a deep concentration of scientific talent. It has specialised in advanced industries.

It is a great example of what urbanist Saskia Sassen calls a “niche global city”. Tel Aviv has a deep concentration of scientific talent. It has specialised in advanced industries.

But what marks these cities apart, says Sassen, is that they operate in a very broad and diverse set of global circuits.

Take the relationship between China and Tel Aviv.

Since the mid-1970s, China has found in Israel a willing strategic partner: Israel needs markets to export its defence and weapons system, while China needs Israeli expertise in agro-technology, water systems, clean energy and IT.

But the relationship is really thriving today as both countries seek to establish a network of advanced industrial cities. Israel is setting up innovation centers across China to help build a network of 24 city clusters, all linked by high speed rail.

And China is investing heavily in Israeli high tech — nearly $9 billion last year, accounting for fully 25% of foreign investment in that sector.

City States are the Real Engines of Growth

It is these city states, and not a patchwork of nations, that are now the driving force of the global economy.

Already in the UK, London accounts for almost half of Britain’s GDP. And in America, the Boston-New York-Washington corridor and greater Los Angeles together combine for about one-third of America’s GDP.

By 2025, there will be at least 40 such megacities, many of them working together in an intensifying global circuit of technology, capital and talent.

There is a notion that “place” no longer matters in a digitised global economy. That with the arrival of what Marshall McLuhan called the “global village”, we have abolished time and space.

It turns out that cities are still a vital means of organising people and information.

Cities provide a social infrastructure that is vital to innovation. As Jane Jacobs, author of The Death and Life of Great American Cities, has pointed out, innovation depends on face-to-face contact between people with diverse skills working in multiple sub-economies, constantly offering very different perspectives on common problems.

Jane Jacobs: a city has to be “made”

I think the Jacobs’ point is borne out by the ECIV phenomenon — young entrepreneurs want and need to congregate in these physical communes in Shoreditch and the surrounding area. Smart, ambitious and well educated young people like cities and city life.

Cities encourage these entrepreneurs to move into adjacent platforms: just as Michael Bloomberg succeeded as an information magnate because he understood the needs of finance better than anyone in Silicon Valley.

And it suits the multinational companies too. “Global firms do not want one perfect super global city,” says Sassen. “They want many, because the niche global city is a sort of bridge into national economies. The major global cities add to this the export of their specialised knowledge”.

And so Tel Aviv exports telecoms, Singapore does water desalination and life sciences, Dubai does Islamic finance.

Nerd Nation

I think a big factor in this story of partnering cities is the emergence of a global class of entrepreneurs.

Marc Andreessen refers to this group as the Nerd Nation — 40-50 million high octane tech entrepreneurs who have more in common with other nerds, than with people in their native countries.

These entrepreneurs are reshaping industries and their ideas and projects are shaking down into products and services in just a few dozen cities. Sassen identifies three key hubs: Singapore, Dubai and Hong Kong.

I’m also investigating opportunities in Tel Aviv, the Mittelstand, Helsinki, the Pearl River Delta and Seoul/Incheon, to mention a few more.

There are huge network effects at play here. The more technologists and scientists these cities attract, the more they build their skill base, the more companies are spun out, the more platform adjacency we’ll see.

In this series, I’ve spoken about how the Nerd Nation is already looking to overhaul dysfunctional industries — from Automotives to Agriculture to Cybersecurity.

We are living through an age where tech entrepreneurs see themselves as mission control to the future: questioning everything on the fundamental assumption that the world doesn’t work well and needs them and the technologies they develop to work better.

The real question according to Marc Andreessen is: “Would the world be a better place if there were fifty Silicon Valleys?”

His answer. “Obviously, yes.”

That’s the mentality we are dealing with, and I think it is well worth investigating potential investment opportunities as they seek to clear the path for new emerging industries.

I will point to five today…

1. Smart Cities

Former Rust Belt cities such as Pittsburgh are seeking to reinvent themselves by hosting self-driving experiments and rolling out the red carpet for tech companies, but the cities most likely to benefit are those already investing in retrofitting for advanced industry.

There are investment opportunities in integrated water and energy management, in smart city systems <such as traffic control>, in surveillance, smart lighting, autonomous mass transit and smart construction.

On the latter, Komatsu will use drones and robot equipment to eliminate the need for armies of human building site workers in the construction of the Tokyo 2020 Olympic infrastructure.

Other companies in the vanguard of Smart City development include IBM, Cisco, Intel, GE, Oracle and Schneider Electric.

2. $53 trillion in the Infrastructure Pipeline

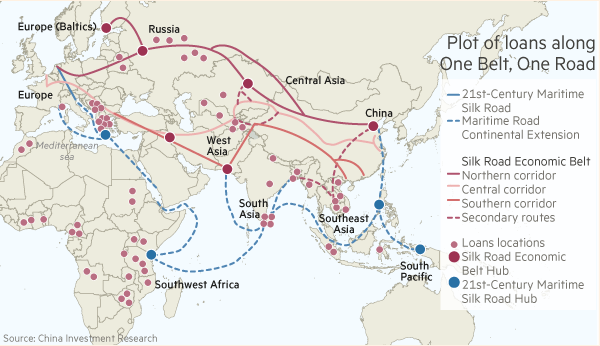

In the East, it’s a case of building a more basic infrastructure. There is some $53 trillion in urban infrastrastructure development in the pipeline worldwide, including China’s ‘one belt, one road’ project to create a new Silk Road to link China to Europe.

This will be spearheaded by Chinese SOEs such as China Railway Group. China is as much the world’s civil engineer <along with Japan which is making a big play to help develop India’s infrastructure> as it was the world’s workshop.

Among other things the ‘one belt, one road’ build out will help reduce the chronic global overcapacity due to Chinese SOEs in steel, cement and aluminium.

3. China is looking to Germany

For investors, it’s also a question of recognising the strategies of these city states and the cities they will partner with.

Recently China’s Midea acquired a controlling interest in German robotic giant Kuka for $4.6 billion. This has to be seen in the context of a China’s ambitions to dominate the robotics industry and its partnership within Germany under the Industrie 4.0 program.

Chinese interests have acquired 37 German companies this year compared to 24 acquisitions during the whole of 2015. I would not be surprised if Chinese interests seek to do a Kuka with semiconductor company Infineon. Chinese interests have long been welcome in the Mittelstand.

4. Israel will continue to thrive

With high-tech start-ups in cyber security, batteries and sensors and advanced vision systems <eg, Mobileye>, Chinese conglomerates are actively looking for Israeli tech companies to invest in or acquire.

5. India

And as for India, infuriating India, having worked there myself and having built a strong intelligence in recent months on developments there, I’m in the process of writing a report on “the Next China”.

I’ll be sending this and several other bespoke reports to subscribers of my Signum Intelligence reports.

But feel free to get in contact if you have any general queries about companies or cities you are investigating. You can reach me here.

In the meantime, I’m busy writing the final article in this series — more on that later in the week.

I’ll be sketching out how over the next ten years, companies will invest in a host of technologies — sensors, machine learning, virtual/mixed reality — to glean ever more actionable data from our cities.

And how this actionable data will mutate to anticipatory data and finally to constant augmented intelligence as we are regulated, protected and supported by networks of autonomous machines.