- BATs to take control of Chinese car industry

- A future-filled Israeli company for your watchlist

This article is the second in a series about investing in technology — arguing that the key to finding great opportunities and negotiating the next few years of wild industrial weather is to focus on technologies that produce actionable data, and in particular, those companies that are terraforming the planet for digital life. You can read the first article here.

“You can either put up red tape or roll out the red carpet. If you want to be a 21st-century laboratory for technology, you put out the carpet”.

So says mayor Bill Peduto as Uber begins trialling self-driving vehicles this week in the former steel town of Pittsburgh. In the coming days, Uber will release 100 modified Volvo jeeps into the general population, each mounted with cameras and GPS units on the roof, and a flesh and blood monitor behind the wheel to make sure there are no major incidents.

Peduto has adopted a hands off approach to this trial — offering no support from police or emergency services, batting down objections from state officials. The experiment will be watched closely by rival cities in the former Rust Belt, who are planning to launch self-driving schemes of their own.

It’s a sign of the lengths that cities are willing to go to attract tech investment — partly in the hope of gaining traction in an advanced, high profile industry.

Singapore was the first to launch a self-driving experiment, with NuTonomy running autonomous taxis on a 2.5 square mile circuit through the city since August.

Google, Tesla, LeEco, Faraday Future and even Dyson are all trialing their own vehicles.

China’s Grand Experiment

My take: I expect China to lead the world in the mainstreaming of autonomous, new energy vehicles.

By 2025, I believe it will become the world’s 250 million passenger test laboratory for self-drive cars and buses <250 million being the size of China’s urban millennial population vs, 89 million in the US>.

I certainly don’t underestimate the significance of the experiments in Pittsburgh and Singapore, but the sheer scale and political force behind a mass transition to autonomous EVs in China is staggering.

As President XI put it recently: ”as a socialist society we can pool resources in a major mission”, and this transition is a high priority major mission for Xi and the Politburo Standing Committee as they seek to attack urban pollution, chaotic traffic conditions in major cities and a deep dependence on imported oil.

The Politburo is charging tech giants Baidu, Tencent and Alibaba (BAT) with the challenge of overhauling the transport system, as it doesn’t think China’s legacy auto makers are up to the task.

The technical challenge is formidable…

One of the most important elements in an autonomous driving system is the map of the local terrain. When Google began it’s self-driving experiments in 2009, it was able to draw on the extremely detailed 3D maps captured by its Google Street View project.

Loaded with sensors, Google’s self driving cars continued to update these 3D models by extracting vital data from the local environment — features such as road edges, signs, guard-rails and overpasses. Gyroscopes and altimeters provided accurate positioning by relaying data from global-positioning systems.

Two million miles of raw data

And so Google accumulated a vast store of data after racking up more than 2 million road miles since 2009.

Tbe BATs, are busy trying to do that same. Baidu, for example, will seek to incorporate its own search software, BaiDu Maps, but these cars will still need to be fed by millions of urban users adding information and photos from Baidu apps once they are on the streets.

Another major element is the self-learning capability of the car. Baidu can tap into it’s expertise in deep learning, led by pioneer AI scientist Andrew Ng, who helped create the Google Brain project. Tencent and Alibaba will supply AI expertise of their own.

Still it’s not exactly an ideal environment to trial a nascent technology.

China’s sometimes chaotic road conditions will cause havoc — with traffic jams that span 50 lanes and a culture of ignoring basic rules of the road. So far, most of the car and tech firms developing this tech have runs tests on highways or pleasantly quiet suburbs.

Outlawing human drivers

However, there are compelling reasons why China might be able to make a sudden transition to a transport system based on self driving subscription vehicles, ride sharing and the emergence of fleets of robot buses and transit carriers…

- Private car ownership isn’t the norm in China — there’s less than 5% car ownership. Relatively few Chinese have an urge to drive in clogged cities where there are over 200,000 road fatalities a year vs a ‘mere’ but still appalling 33, 000 in the US.

- Urban millennials across the world, especially in China, are tending towards on-demand mobility in traffic clogged, and polluted environments to avoid the hassle and cost of car ownership — a 95% downtime asset that needs taxing, insuring, maintaining and parking — without sacrificing too much freedom and flexibility.

- China Inc is very determined and is putting a lot of wood behind this self-drive EV arrow. A medley of protectionist policies is already being put in place. The south-eastern city of Wuhu is even planning to outlaw human drivers by 2019.

I believe that Chinese cities will be a testing ground for a sudden transition towards self driving vehicles, with 250 millennials feeding data to BAT-controlled systems of public and private vehicles. And this transition will happen a lot sooner than people think.

Terraforming Cities

In short, the transport system in China and elsewhere is digitising, just as the phone system digitised, just as the energy system are every other system is digitising. We are witnessing tech companies terraforming cities — an effort to create the ideal conditions for digital life.

Devices from cars to phones to traffic lights and satellites are connecting, gleaning information from our environment so that it can be processed by machine learning algorithms into a stream of actionable data.

The car will be reimagined, notably by such insurgents as Google, Tesla, Tencent and Baidu. This is already forcing the legacy OEMs like Ford and GM, which are themselves being ‘hollowed out’ by such tech savvy system component suppliers as Continental and Delphi, to snap out of their typical seven year fleet renewal cycles and 1950s way of thinking.

By 2025, an over-supplied and over-thronged market is in prospect, with a supply side carrying a lot of sunken R&D and capital costs as linear projections of classic car ownership collapse in favour of Baidu, Uber, Didi Chuxing, Ola models of subscription and public vehicles.

This early shift towards self-driving vehicles will be problematic. Laws will have to be changed, regulations designed and imposed, people will die in accidents .

It’ll be a mess. But probably not in China, where an autocratic government has thrown its weight behind self-drive.

Add to your watchlist: Mobileye

For investors looking for a way of betting on the future of self-driving cars: I see Israel’s Mobileye (NYSE: MBLY) as the most future-filled company in this field. It does nothing else apart from developing ADAS <advanced driver assist systems> — a ‘pure play’ way on self driving ambitions in China.

The case for me can almost be summarised by the fact that while less than 1% of Chinese vehicles currently have ADAS systems, while the Ministry of Transportation is likely to make them mandatory in heavy vehicles and buses within the next few months and eventually in all vehicles.

Hence, leading Chinese finance house Citic Securities sees a $30 billion Chinese ADAS market by 2020 from nothing today.

My bet is that Mobileye will be in the vanguard, and in fact the company is already involved directly or indirectly with a slew of vehicle makers and system component suppliers who will be attacking that market. I can’t find an erstwhile Chinese domestic competitor. But will obviously keep my antennae sharpened.

Meanwhile, Mobileye is a distinct leader in the field everywhere else with some 90% of global motor manufacturers on its books.

So what does it do?

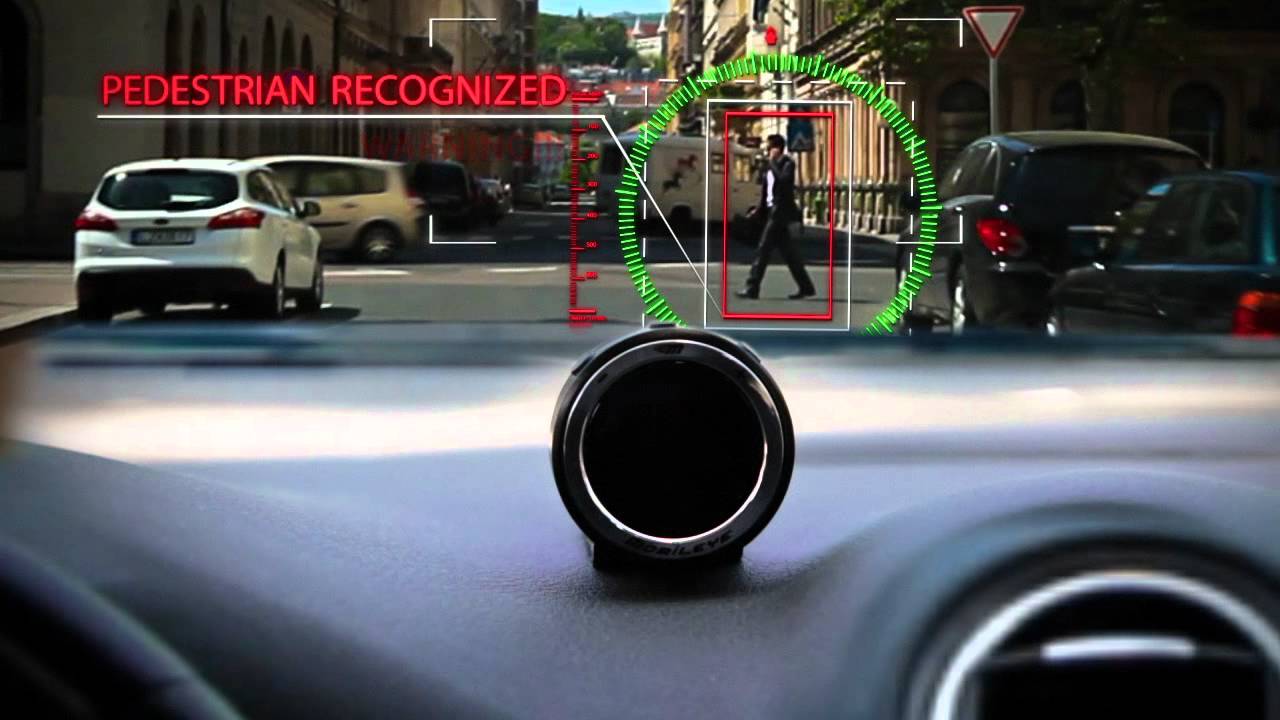

Mobileye develops software and sensors that enable vehicles to ‘see’ what’s happening just ahead and issue actionable data to the driver and the vehicle itself to avoid accidents.

Its systems apply algorithms to video images taken from forward placed smart sensors, essentially the driver’s ‘third eye’, that detect pedestrians, cyclists, traffic lights, lane departures, speed traps, other vehicles and other relevant ‘events’ and issue video and audio alerts. In extremis the system triggers automatic braking.

Mobileye: a third eye for drivers

At the sensors’ hardware cores are the company’s proprietary EyeQ chips, which are evolving into the central processors of sensor fusion for fully autonomous vehicles and are being co-developed with semiconductor giant ST Micro.

Mobileye’s collision avoidance systems are being progressively installed in GM, VW, and BMW vehicles and significant in the context of the main thesis of this piece the new SUV designed by SAIC Motor and Alibaba.

They are also at the core of the ADAS sub-systems of Tier-1 auto component suppliers Delphi Automotive and Magna. BMW, Intel and Mobileye are in close collaboration to bring full vehicle autonomy to fruition by 2021.

You get the picture.

But of course there are serious risks here. There’s competition in the form of LIDAR — the roof-top laser based technology approach favoured by Alphabet and Toyota <though Mobileye systems are cheaper>.

.And NXP and Nvidia are entering the fray to wobble Mobile’s foothold.

The company’s share price, which has been a royal rating since the IPO two years ago, was hammered when it lost the Ford account last winter and then again this summer when thad to part company with Tesla over the AutoPilot snafu. A Mobileye system was involved in the car in which the driver was killed. The investigation is not yet complete but preliminary ‘leaks’ suggest that the driver was operating as though the vehicle was fully autonomous, and ignoring Tesla’s clear instruction to always keep his fingers on the wheel. We shall see.

Meanwhile despite Ford and Tesla, Mobileye’s revenues are on the growth trajectory of over 40%, and the business operates on a gross margin of over 75%.

Neither looks set to deteriorate. Arguably, Mobileye and the ADAS industry as a whole are only limbering up for the main event.

Note: Self-drive and electric tend to get bundled together in forward looking coverage but I prefer to keep them apart, so will be posting you thoughts on EVs separately — again, with due attention to what’s sparking in China.

I’ll be showing how and why Elon Musk and his GigaFactory isn’t the only show in town. China is launching a determined and lavishly State supported counter-campaign in order to do in batteries what it did in PV solar panels.

Obviously this puts high profile Warren Buffett investment BYD, China’s biggest battery maker into the frame as well as an intriguing new player Contemporary Amerpex Tech, which may be poised for what could be an interesting IPO. At the same time, China Molybdenum’s move on DRG’s Tenke mine puts the geopolitics of cobalt into the headlights.

In the next article in this series — which I’ll send to you on Wednesday — we’ll look at another company terraforming a dysfunctional environment. This time: Agriculture.

PS: Apple scaling down it’s car project… I feel I should be standing in white sackcloth and ashes as I didn’t get wind of the pivot at Project Titan. There is almost certainly a power struggle going on between Jony Ive’s Industrial Design division and the rest of Apple over the car with the former dead keen to transform the way cars are designed and made and to make it a worthy Jobs legacy.

Interesting that Ive is scarcely ever at the Apple HQ these days. That aside, the engineering team at Titan seems to have concluded that it’s too difficult and risky for Apple to attempt it on its own. After all Google has come to the same conclusion. It adds to speculation about what exactly lay behind Apple’s $1 billion investment in Didi Chuxing.

Surely more than a promising portfolio investment decision? I’ll try to do better at sussing that out than I have with Project Titan. But we still can’t completely count out the prospect of an Apple vehicle.

For daily tech news, follow me on twitter

PS: If you would like to discuss how I can work with you and/or your company please get in touch here.