- It Promises to Disrupt and Transform A lot More Than Banking…Almost Every Industry is Building a Version of its Own!

A fascinating development this week at DeepMind, the deep learning subsidiary of Google.

It is creating a blockchain-like system to reveal exactly how patient records of 1.6 million individuals from three London hospitals are being used to train it’s machine learning efforts with the NHS.

This is partly an exercise in PR and trust building. Last year, DeepMind got in a bit of hot water when it was revealed that it had gained access to deeply sensitive patient records — information that went far beyond the scope of the research they had publicly disclosed.

This included data about people are who are HIV-positive, as well as details of drug overdoses and abortions from the last five years.

But there is a bigger story here that needs to be recognised…

Why every industry is moving to back “Digital Ledgers”

Patient confidentiality is a major issue in the West and huge databases of ‘confidential’ patient information are needed, and will be increasingly needed to make advances AI work.

So DeepMind has decided to tackle this problem by building what it calls a ‘verifiable append only ledger’….

“Dubbed “Verifiable Data Audit”, the plan is to create a special digital ledger that automatically records every interaction with patient data in a cryptographically verifiable manner. This means any changes to, or access of, the data would be visible.

“[An] entry will record the fact that a particular piece of data has been used, and also the reason why, for example, that blood test data was checked against the NHS national algorithm to detect possible acute kidney injury,” they write.”

This is a significant development…

Last December I wrote about blockchain as a big developing story for 2017, focusing largely on the benefits for the financial industry. Rereading it, I actually touched on less half the story.

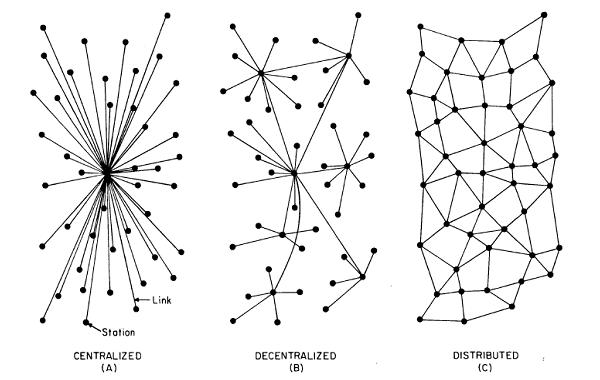

While the term ‘blockchain’ is used more frequently than ‘distributed ledger’, a blockchain is only one of many types of distributed ledger.

In the case of bitcoin, the blockchain is shared and validated by a “proof-of-work” system, where miners work through computational tasks, validating each new block on the chain using a cryptographic signature (called a ‘hash’). It’s impossible to change a specific entry secretly, as this alters the hash value and disrupts the data trail.

But there many, many alternatives to the proof-of-work method of building trust and consensus — depending on the needs and appropriate applications for that industry.

While the likes of Goldman Sachs, Santander and Data Asset Management are aggressively front testing and developing DLT use cases in banking, almost exclusively for post trade back office reconciliation and settlements, others such Google, IBM, Microsoft and Cognizant are developing applications in industry, medical research, real estate, and smart grids. The momentum is building across the board.

What are the benefits?

Identification, Authenticity, Security, Speed and Cost <removing intermediate steps and costs eliminate human intermediaries>…

It could also help thwart hackers and cyber criminals…

Just contrast a DLT with a conventional database.

A conventional database rests in one place and is often accessible using passwords (very insecure)…by relatively large numbers of people who are rarely submitted to strict ID and authentication procedures.

A DLT is distributed rather than centralised. It shares the same precise information across multiple autonomously synchronised servers. It is managed by consensus algorithms and advanced cryptography.

A true distributed ledger represents, records and securely and accurately stores and enables exchanges between authenticated digital ‘tokens’, and here comes the rub.

A true distributed ledger represents, records and securely and accurately stores and enables exchanges between authenticated digital ‘tokens’, and here comes the rub.

These ‘tokens’ can be anything from cryptocurrencies to title deeds and from medical records to machine-to-machine communicating devices in the IoT.

In any network of machines, it creates a public, transparent record. Indeed without the widespread use and scale up of DLT, IBM, Cognizant, Accenture among others see an IoT of upwards of 20 million connected ‘things’ as being unmanageable and dangerously prone to sabotage.

DLT is being spawned and developed in an age when the security and integrity of networks involving valuable assets — whether currencies, title deeds, medical records or M2M communicating devices on the IoT — are not trusted.

The spread of DLTs will be a real threat to hackers and cyber-criminals….if adopted, for instance, by hospitals and health centres they would not just protect patient confidentiality but rub out the phenomenon of ransomware viruses which lock files for release on payment of a ransom, usually in bitcoin….there have been 14 cases in the US in the first 9 months of last year.

What every industry craves

DLT is now being applied in medical research. It is also in use in land registration, IoT, smart grids, and fiat currencies.

The process is starting and is accelerating despite a current lack of standards and protocols, scale and ease of integration with existing technologies.

These are non-trivial challenges, but somewhat like the challenges facing 5G. It would be unwise to bet against the disruptive and transformational power of DLT: now invisible to many radar screens.

What was originally like something that landed from Mars in 2008, now uses code, consensus algorithms and advanced cryptography to hold out the prospect of the ‘internet of trust’ that every industry craves.

Regards

Michael

Drop me a message here if you have any queries or questions.

Follow me on twitter here.